Influencer

Are Federal Prosecutors Cracking Down on Influencer “Pump-and-Dump” Schemes?

Social media is an incredible and influential tool, which is highly beneficial when it is used for good.

When used correctly, social media and high-profile influencers can hold governments accountable, share news stories, and help people connect across the world.

Movements such as Black Lives Matter, for example, would not have happened without social media and high-profile influencers getting behind the movement.

However, social media is not always used for good, and some high-profile influencers take advantage of their following to make a quick profit.

What Is Pump-and-Dump?

Pump-and-dump schemes prey on inexperienced investors and leave them in the lurch when the investment tanks.

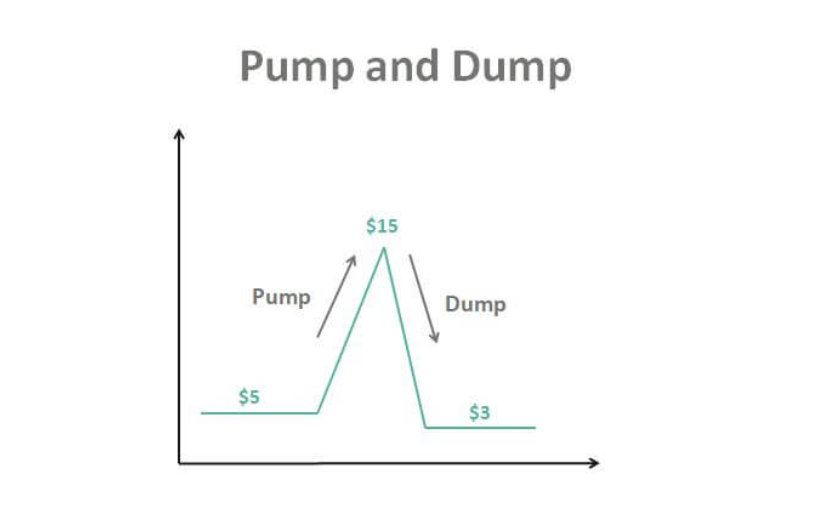

A pump-and-dump scheme tries to manipulate the price of a stock by using fake recommendations. These recommendations are manipulative, as they tend to be based on misleading, exaggerated, false, or paid statements.

Those running the pump-and-dump scheme have already decided what position they will sell their stock at, and once they have manipulated it to that price, they leave the other investors to pick up the pieces.

The process is illegal and, if proven, can lead to heavy fines.

However, the recent surge in the popularity of crypto has led to many influencers using this scheme as an opportunity to make extra money from their loyal followers.

The History of Pump-and-Dump

Pump-and-dumps have been prominent since long before the introduction of social media influencers.

Traditional pump-and-dump schemes tended to occur via cold calling people in an attempt to get them onto the “next big thing.”

You may remember the scene from the Wolf of Wall Street where Jordan starts selling penny stocks. Here, he talks about how incredible the investment opportunity is, states the stock is about to take off and uses urgency messaging to convince the call recipient to invest there and then.

Since the inception of the internet, most pump-and-dump schemes have moved to online activity.

Originally, fraudsters would focus on firing off thousands of emails to naive recipients or posting messages online to entice people to purchase the stock as fast as possible.

However, this went to all new heights as social media influencers began to take prominence. Companies began to realize they would gain much more success if they worked directly with social media icons, spending money asking them to promote their scheme.

Their following was already built in and loyal to a fault, so converting them into investors was much easier than via cold emails and messages.

From there, some social media influencers decided to skip out the middleman. The age of cryptocurrency allowed many influencers to quickly create their own coin and push it immediately to their following.

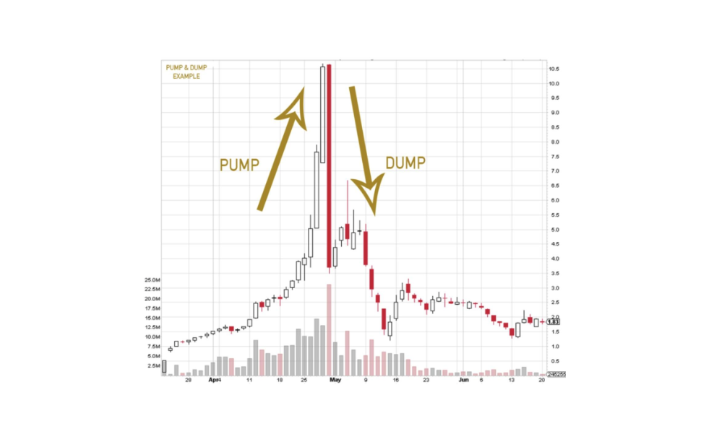

One of the most prominent examples of this occurred when three FaZe clan members created their own alt-coin called Save The Kids. They promoted this coin to their passionate following, stating that some of the proceeds would go to charity, and quickly many people invested.

However, two days later, all three members cashed out, and the stock crashed. While no official charges have gotten brought to them, all three were kicked out of FaZe clan for the pump-and-dump scheme.

Digital Pump-and-Dumps

The evolution of cryptocurrency and social media influencers has led to many digital pump-and-dumps.

This scheme can be executed by anyone with access to online trading accounts and the ability to persuade others to purchase stock they claim is “ready to take off.”

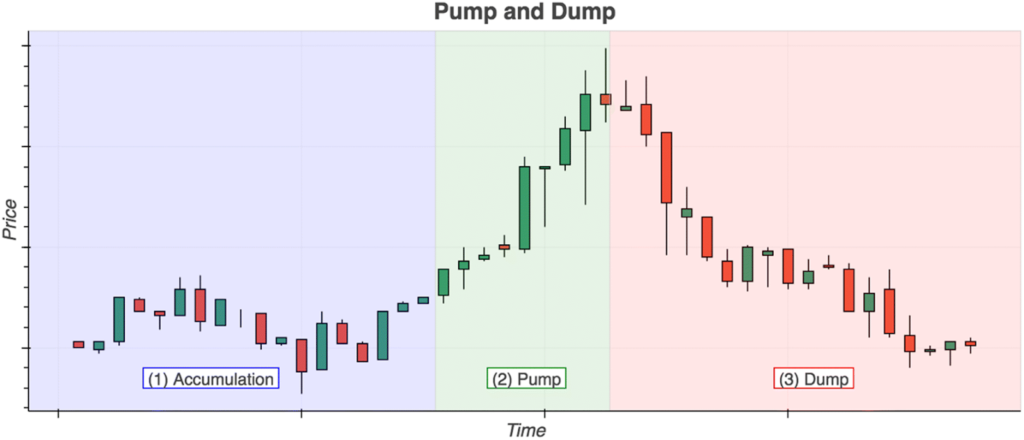

The perpetrator can start the action by purchasing large volumes of the stock, which kickstarts the price rise.

Once the stock price begins to increase, they can use their influence to persuade other investors to purchase, further increasing the stock price. Once they feel the price has peaked and it is about to drop off, they dump their shares and make a massive profit.

As you can imagine, this process is highly achievable as a large social media influencer. Chances are they already have the funds available to get the process started, and they can then use their mass following on various social media platforms to convince novice investors, who often have little to no prior experience trading, but trust the follower with their money, to invest heavily and increase the stock price.

Once they have dumped the stock, they will lose some of their following, but with the right PR program in place, many followers will stay, and they will pocket a hefty sum in the process.

The rise of cryptocurrencies led to many influencers utilizing this scheme, as the currency is deregulated, and at first, no one was getting in trouble with federal prosecutors, as digital pump-and-dumps were so new and unprecedented.

Why are pump-and-dump schemes prominent with influencers?

Social media influencers have dedicated, passionate followers, that rest on their every word.

Pump-and-dump schemes are prominent with influencers for several reasons. For starters, when done effectively, they make the perpetrator some serious profits. Often, social media influencers do not have financial or economic backgrounds, and some may not even be aware what they are doing is illegal.

Instead, they focus on the profits and tell themselves that they didn’t force anyone to invest in the crypto coin, so it’s not their fault if people lose money.

Some influencers are slightly more savvy to pump-and-dump schemes, but morally they decide to take the risk. While some influencers value their community highly, others simply see it as a way to make money, and a successful pump-and-dump scheme is sure to do that.

Finally, the lack of regulations in place makes executing a pump-and-dump scheme incredibly easy, so the access barriers are so low almost any high-profile influencer can get involved.

Final thoughts

As the world continues to get to grips with the rapid growth of the digital ecosystem, expect to see plenty more crackdowns on pump-and-dump schemes from influencers in the future.

Federal prosecutors are continuing to gain a better understanding of the social media and cryptocurrency world, which will only help them in their quest to sentence people with fair and reasonable convictions.

This increased understanding will also influence any additional rules and regulations that get added to counteract this action. While some regulations have already gotten rolled out in recent years, expect even more detailed ones to appear as lawmakers get to grips with these get-rich-quick schemes.

We have already seen the SEC increase its crackdown on social media influences promoting financial products, including a recent ruling that prevents Kim Kardashian from promoting crypto for at least three years. She was also fined $1 million for recommending a cryptocurrency to her followers without disclosing it was a paid advertisement.